Chicago’s South and West Sides are experiencing a surge of anger and frustration as residents and community leaders voice their outrage over recent Cook County property tax increases. They are demanding immediate relief, arguing that they are bearing a disproportionate burden due to unfairly steep hikes.

The Leaders Network, a coalition of faith and community figures, convenes monthly in the Austin neighborhood on Chicago’s West Side. At their recent meeting, the escalating property taxes took center stage, with community leaders advocating for a freeze on further increases.

Pastor Marshall Hatch of New Mount Pilgrim Missionary Baptist Church, a prominent voice in the community, stated emphatically, “This system is rigged. It can’t be fair.”

An analysis conducted by the Cook County Treasurer’s Office reveals a concerning trend: the median residential property tax bill in Chicago has risen by a record-breaking 16.7%. However, this increase is not evenly distributed across the city. The data indicates that residential property values and associated tax bills have seen the most significant percentage increases in the South and West Sides, exacerbating existing economic disparities.

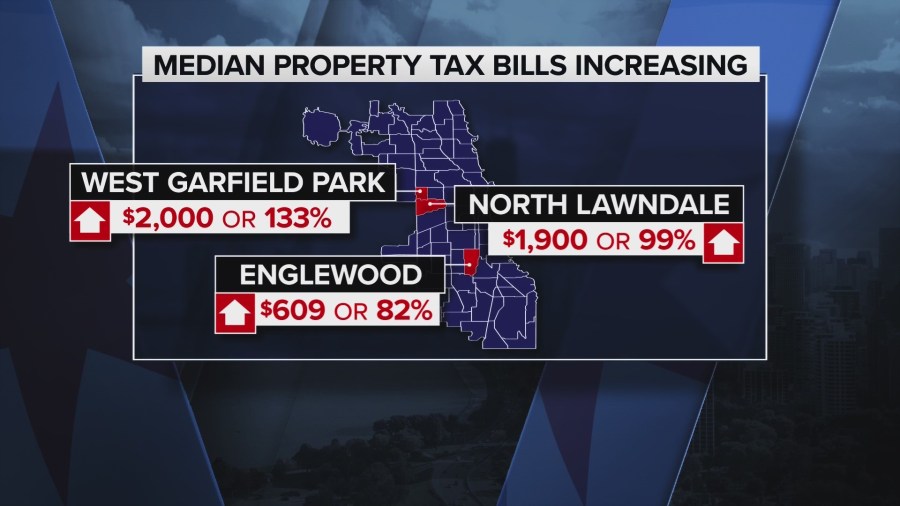

Specific areas have been particularly hard hit:

West Garfield Park: Residents are facing an average increase of $2,000, representing a staggering 133% rise.

North Lawndale: Homeowners are grappling with an average increase of $1,900, a substantial 99% jump.

Englewood: Residents are experiencing an average increase of $609, an 82% increase.

Cook County Assessor Fritz Kaegi addressed concerned residents at an emergency town hall meeting organized by faith leaders on the West Side. Kaegi explained that the shift in the property tax burden stems from declining commercial property values in Chicago’s Loop. He further noted that large data centers and downtown hotels have successfully appealed their property taxes, leading to reductions that have shifted the burden onto residential areas.

During the meeting, Pastor Hatch challenged the fairness of a system that disproportionately impacts those who can least afford it. Many residents fear that they may be forced to leave their homes if immediate intervention is not implemented.

“If the poorest people are called to pay the most, the people who can least afford to pay have to pay the most, it means it’s a rigged system,” Hatch asserted. “And it needs to be changed. And so we’re calling for the freeze, and we don’t want to hear anybody say they can’t do it. Somebody’s going to do it.”

The emergency town hall meeting drew over 300 Chicago residents, all demanding relief from the crushing weight of increased property taxes.

Dorothy Rosenthal, a resident of West Garfield Park, voiced her personal struggle: “My tax bill is still $1,600 over what it was last year. What about us?”

Chicago Alderman Monique Scott (24th Ward) expressed her deep concern for homeowners in the West and South Sides: “Many of you sitting right here could lose your home in the next year or two, and I can’t stand for that. I’m sorry.”

Hatch has been particularly vocal about the disproportionate impact of the property tax crisis on Black homeowners.

“This is clearly a property tax crisis that’s hindering Black people,” he stated. “When homes near Wrigley Field on the North Side get a marginal increase and millionaires downtown get a 25% decrease, something is wrong with that.”

Kaegi acknowledged the existence of a system of appeals that results in reductions for some, which then shifts the tax burden onto others. “There is a system of appeals where there are reductions being made and pushed onto us in this neighborhood, that is pushing the tab onto others,” Kaegi explained. “That’s why I feel the greatest sense of indignation.”

Tracy Jones, a resident of North Lawndale, highlighted the growing movement to unite and fight against the higher bills, challenging what they perceive as a fundamentally flawed system.

“We ain’t moving, we’re not leaving, and we’re not scared,” Jones declared. “We are going to fight, fight, fight.”