HDB Rental Market Sees Upward Trend Driven by International Students and Upgraders

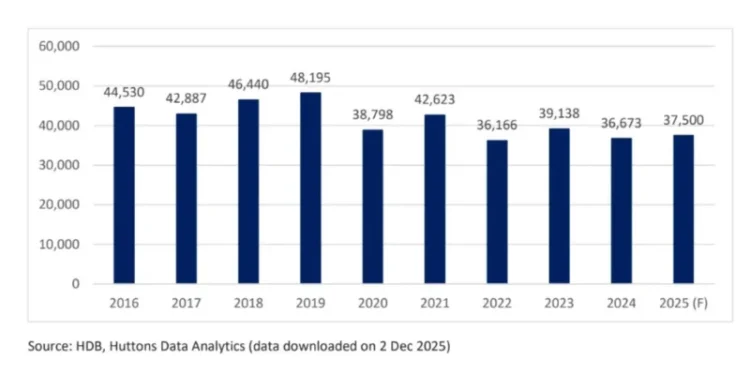

The Housing & Development Board (HDB) rental market in Singapore is poised for growth, with projections indicating a 2.3% increase in rental transactions for 2025. This would see the number of deals rise from 36,673 in the previous year to an estimated 37,500. This anticipated surge is being fuelled by a confluence of factors, including a notable influx of international students seeking accommodation and a segment of HDB dwellers looking to upgrade to private properties.

The demand from international students is a significant contributor. As Singapore continues to attract talent and foster its position as an educational hub, the need for accessible and affordable housing for these individuals has become more pronounced. Many international students, navigating a new environment, often turn to the HDB rental market as a practical and cost-effective solution while they settle in and explore their options.

Furthermore, the HDB rental market is also benefiting from a growing trend of “HDB upgraders.” These are existing HDB flat owners who have purchased private properties but are awaiting the completion of their new homes. During this interim period, they opt to rent an HDB flat, creating a temporary but substantial demand. This phenomenon highlights the dynamic nature of Singapore’s property market, where the HDB segment serves as a crucial stepping stone for many aspiring homeowners.

New Home Sales Surge Amidst Shifting Rental Dynamics

The latter half of 2025 (H2) also witnessed a robust increase in buying demand for new homes. Data compiled from lodged caveats reveals a compelling statistic: approximately 15% of buyers acquiring new private properties in H2 had previously resided in HDB flats. This indicates a strong pipeline of upgraders transitioning from public housing to private residences, underscoring the aspirational nature of homeownership in Singapore.

Despite the positive outlook for rentals and new home sales, the HDB rental market has not been without its challenges. The first half of the year saw a dampening effect on demand due to approximately 600 job losses among S Pass holders. This segment of the workforce often plays a role in the rental market, and a reduction in their numbers can translate to a temporary slowdown in rental activity.

HDB Remains a Pillar of Affordability in Asia Pacific

In a significant recognition of Singapore’s public housing system, HDB flats were identified as the only housing segment in any Asia Pacific capital city that remained attainable for purchase. This finding was highlighted in the 2025 ULI Asia Pacific Home Attainability Index, a report published by the Urban Land Institute Asia Pacific. This distinction underscores the government’s ongoing commitment to ensuring housing affordability for its citizens, a cornerstone of social stability and economic well-being.

In response to sustained housing demand and to further bolster affordability, the Minister for National Development, Desmond Lee, announced an ambitious plan to launch over 50,000 new flats between 2025 and 2027. This significant pipeline of new HDB flats aims to cater to a wide range of buyers, including first-time applicants and those looking to upgrade within the public housing framework.

Car Ownership Trends: A Tale of Two Housing Segments

Interestingly, data from Acting Minister for Transport, Jeffrey Siow, sheds light on car ownership patterns across different housing types. The statistics indicate that households not residing in HDB flats are more likely to own multiple vehicles, with a greater proportion of non-HDB households owning at least two or three cars compared to their HDB counterparts. This observation may reflect differing income levels and lifestyle choices associated with private versus public housing residents.

The interplay between the HDB rental market, new home sales, and evolving housing trends paints a complex yet dynamic picture of Singapore’s property landscape. The sustained demand, driven by both international factors and domestic aspirations, alongside government initiatives to ensure housing affordability, positions the HDB sector as a resilient and vital component of the nation’s housing ecosystem.