South Korea’s Wealthy Population Surges, Outpacing General Households

Seoul, South Korea – The ranks of South Korea’s affluent individuals, defined by their possession of financial assets exceeding 1 billion Korean won (approximately $720,000 USD), have seen a significant expansion. Latest estimates reveal that the number of these high-net-worth individuals has climbed by over 3% in the past year, pushing the total beyond the 470,000 mark. This growth trajectory highlights a widening asset accumulation gap between the wealthiest segment of the population and the general populace.

The comprehensive ‘2025 Korean Wealth Report,’ released by KB Financial Group’s Management Research Institute, provides a detailed analysis of this burgeoning wealth. As of the close of the previous year, the number of individuals holding financial assets of 1 billion won or more was estimated at 476,000. This figure represents 0.92% of South Korea’s total population. Notably, this represents a substantial 3.2% increase from the preceding year. Looking back further, the growth is even more dramatic, with the number of wealthy individuals more than tripling compared to the 130,000 recorded at the end of 2010.

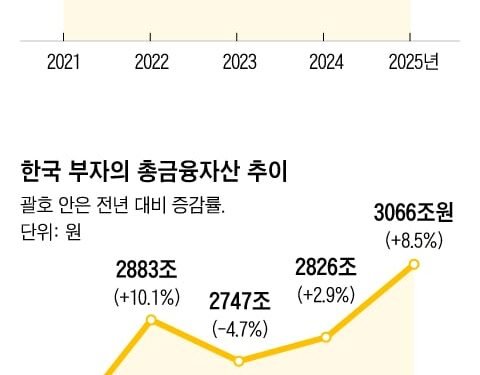

Total Wealth and Asset Growth Dynamics

The aggregate financial assets held by South Korea’s wealthy individuals reached an impressive 3,066 trillion won by the end of last year. This represents an 8.5% surge from the previous year, significantly outpacing the growth rate of overall household financial assets. The total household financial assets stood at 5,041 trillion won, with a growth rate of 4.4%. This disparity underscores a key finding of the report: the asset accumulation among the wealthy is accelerating at a pace double that of average households.

The primary drivers behind this robust asset growth for the affluent were identified as:

- Business Income: Contributing a significant 34.5% to asset growth, indicating the success of entrepreneurial ventures and business ownership.

- Real Estate Investment Gains: Accounting for 22% of the growth, demonstrating the continued appeal and profitability of property investments.

- Financial Investment Gains: Making up 16.8% of the increase, reflecting successful strategies in stock markets, bonds, and other financial instruments.

The average financial assets held by each wealthy individual in South Korea now stands at a substantial 6.8 billion won.

Categorizing the Affluent: A Stratified Landscape

The report further dissects the wealthy demographic into distinct categories based on their asset holdings:

- Asset Holders (1 billion to 10 billion won): This segment forms the largest group, comprising 90.8% of the wealthy population, totaling 432,000 individuals. They represent the foundational tier of affluent individuals.

- High-Net-Worth Individuals (10 billion to 30 billion won): This category includes 6.7% of the wealthy, numbering 32,000 individuals. These individuals possess a more considerable financial cushion.

- Ultra-High-Net-Worth Individuals (over 30 billion won): This elite group constitutes 2.5% of the wealthy population, with 12,000 individuals. They command the highest levels of financial resources.

Asset Allocation and Investment Preferences

A detailed face-to-face survey, conducted between July and August of the current year with 400 wealthy individuals, offered insights into their preferred asset allocation. On average, their wealth is distributed as follows:

- Real Estate: 54.8%

- Financial Assets: 37.1%

A more granular examination of asset composition revealed the following key holdings:

- Residential Housing: 31.0%

- Liquid Financial Assets (e.g., cash): 12.0%

- Non-Residential Housing (e.g., commercial properties): 10.4%

- Savings and Deposits: 9.7%

- Buildings and Commercial Properties: 8.7%

- Stocks: 7.9%

For those wealthy individuals who actively invest in the stock market, the average portfolio included 5.8 domestic stock positions and 4.9 overseas stock positions.

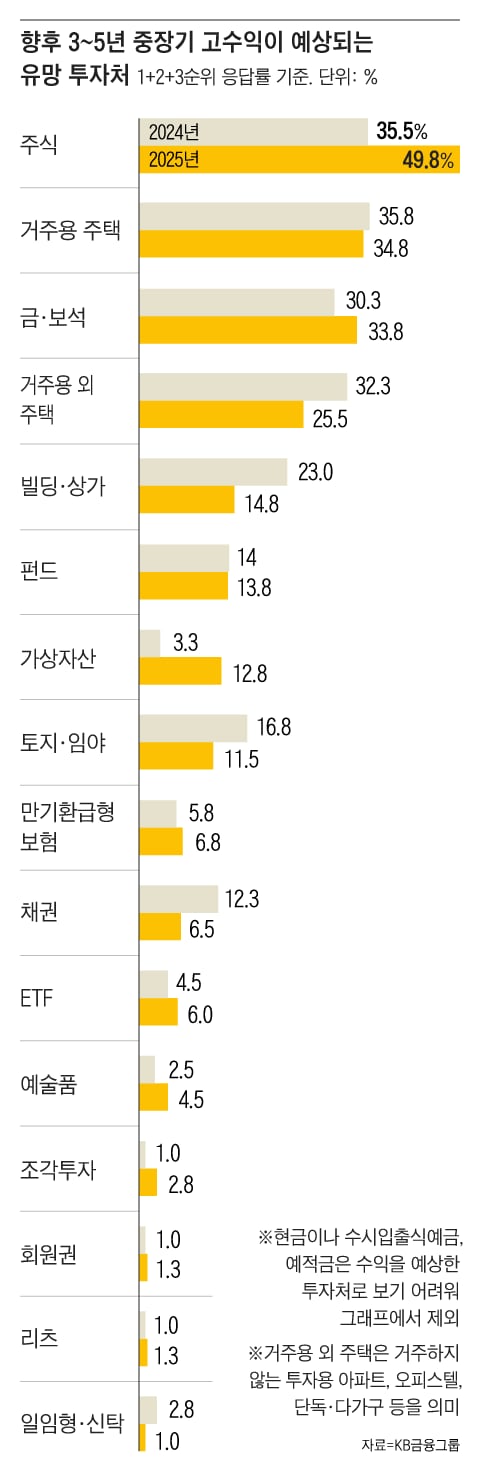

Investment Outlook: Stocks Lead the Charge

When asked about their most promising investment avenues for high returns, South Korean wealthy individuals predominantly favored stocks.

Short-Term Investments (within one year):

- Stocks: 55% (multiple responses allowed)

- Gold and Jewelry: 38.8%

- Residential Housing: 35.5%

- Non-Residential Housing: 25.5%

- Funds: 14%

Medium- to Long-Term Investments (3–5 years):

- Stocks: 49.8%

- Residential Housing: 34.8%

- Gold and Jewelry: 33.8%

The consistent preference for stocks, both in the short and long term, suggests a strong confidence in equity markets as a primary vehicle for wealth generation and preservation among South Korea’s affluent population. This trend, coupled with the overall increase in the number of wealthy individuals, points towards a dynamic and evolving economic landscape in the nation.