Nvidia Faces Complex Landscape as H200 AI Chip Awaits Chinese Import Approval

Recent reports suggest that graphics processing unit (GPU) giant Nvidia is planning a significant ramp-up in production for its H200 AI chip. This move comes in response to what are described as substantial order backlogs from Chinese customers, indicating a demand that currently outstrips the company’s manufacturing capacity. The potential for increased H200 shipments to China gains particular significance given the recent development of the U.S. administration granting export approval for this specific chip.

Sources familiar with the matter have indicated to Reuters that the demand from Chinese corporations for these advanced chips is so robust that Nvidia is actively exploring avenues to expand its production capabilities. This proactive approach by Nvidia underscores the immense market interest in its high-performance AI hardware within China.

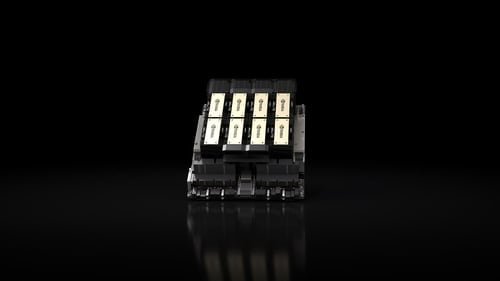

Major Chinese technology conglomerates, including e-commerce titan Alibaba and social media and entertainment powerhouse ByteDance, have reportedly already initiated discussions with Nvidia regarding substantial H200 chip acquisitions. The H200 chip, built upon the well-established ‘Hopper’ architecture, represents the pinnacle of Nvidia’s previous generation of AI processing power. While it may not match the raw performance of Nvidia’s latest ‘Blackwell’-based offerings, the H200 significantly outperforms the more restricted ‘H20’ chip, which has previously received clearance for export to China. Currently, Nvidia’s production lines are heavily geared towards its newer Blackwell and upcoming ‘Rubin’-based chipsets, with the H200 being manufactured in more limited volumes.

However, the narrative surrounding the H200’s entry into the Chinese market remains fraught with uncertainty. The ultimate decision on whether to permit the import of the H200 rests with the Chinese government, which has yet to issue a definitive ruling. Reports suggest that Chinese authorities recently convened an emergency meeting specifically to deliberate on the implications of H200 exports, with an expectation of a decision being reached soon regarding the chip’s potential entry into the country.

Adding another layer of complexity, there are diverging perspectives on China’s likely response. While a statement attributed to former U.S. President Donald Trump suggested a positive reception from Chinese President Xi Jinping regarding H200 export approvals, other analyses present a contrasting outlook. David Sacks, a prominent figure in the U.S. technology policy sphere and an advisor overseeing the Trump administration’s AI strategy, articulated a different viewpoint in a recent interview. He suggested that China’s reluctance to import these chips stems from its overarching ambition to achieve complete self-sufficiency in semiconductor manufacturing.

Sacks elaborated on the strategic thinking behind the U.S. approach, noting that the intention was to offer older, less cutting-edge chips to China, with the hope of capturing market share from domestic competitors like Huawei. However, he posited that the Chinese government perceived this strategy, leading to their current stance on restricting chip imports.

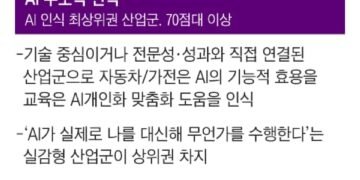

This strategic posture by China is deeply rooted in its pursuit of indigenous innovation and independence in AI chip technology. As the United States has progressively tightened its export controls on advanced AI chips destined for China, Chinese telecommunications equipment giant Huawei has intensified its efforts to develop its own AI chip capabilities, notably with its ‘Ascend’ series. The concern within the U.S. is that the re-introduction of high-performance American AI chips like the H200 into China could inadvertently bolster Chinese companies, potentially slowing down the progress and market adoption of domestically developed AI semiconductor solutions. In line with this drive for self-reliance, reports indicate that China is actively considering a substantial incentive package, reportedly worth up to $70 billion, to bolster its domestic semiconductor industry.