Hollywood’s Blockbuster Takeover Battle: A December Drama Unfolds

As the festive season approaches, Hollywood’s usual romantic Christmas movie fare is being overshadowed by a real-life drama of epic proportions: a high-stakes battle for control of one of the industry’s most iconic names, Warner Bros. Discovery. This corporate tussle, playing out against a backdrop of shifting media landscapes, offers a compelling narrative for investors seeking to diversify their portfolios, proving that in the world of entertainment, business truly is show business.

This week saw a significant development with Paramount, the powerhouse behind blockbuster franchises like Mission Impossible and Top Gun, launching a substantial $108 billion hostile bid for Warner Bros. Discovery, the studio responsible for the magical world of Harry Potter and the acclaimed HBO network, home to series like Game of Thrones.

This aggressive move by Paramount arrived as a shocking plot twist, especially given that Warner Bros. had previously reached an agreement for an $82.7 billion acquisition by Netflix, the streaming giant synonymous with hits such as Bridgerton and Stranger Things. Netflix’s offer comprises $27.75 per share in a mix of stock and cash. In contrast, Paramount is proposing a higher cash offer of $30 per share. Whispers in the market suggest this price could be further elevated, underscoring Paramount’s fervent desire to secure Warner Bros.

The Strategic Imperative for Paramount

Industry analysts are quick to point out the strategic necessity behind Paramount’s aggressive play. Robert Fishman of Moffett Nathanson, a prominent New York-based media analyst firm, commented that “Paramount genuinely needs an acquisition to compete with Netflix, Disney and Amazon, all of which have enjoyed a substantial head-start in global scale, content output and engagement.” This sentiment highlights the intense competition in the streaming wars, where scale and a robust content library are paramount to survival and growth.

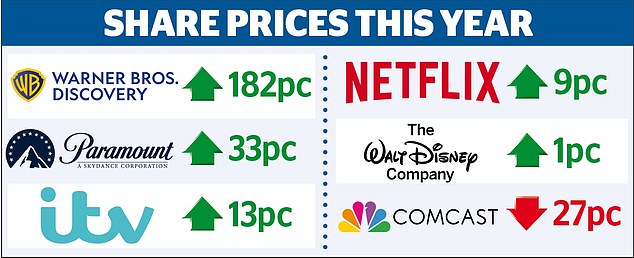

The market has responded with considerable enthusiasm to the prospect of a Paramount acquisition. Since September, Warner Bros. shares have experienced a remarkable surge of 120 per cent, reaching $30. This upward trajectory is largely attributed to the market’s assessment that Warner Bros.’ extensive content library, with HBO often cited as the crown jewel, is an irresistible asset for any potential buyer. Conversely, Netflix’s shares have seen a decline of 22 per cent over the same period, a fall partly fuelled by concerns that the company might be compelled to increase its bid to secure HBO’s coveted content.

The Power Players Behind the Bid

The financial muscle and influential connections backing Paramount’s bid are also noteworthy. The company’s chief executive, David Ellison, is the son of Larry Ellison, the co-founder of tech giant Oracle and one of the wealthiest individuals globally. Furthermore, David Ellison is known to be a close associate of Donald Trump, who reportedly has a keen interest in the future ownership of Warner Bros. Jared Kushner, the former US President’s son-in-law, is also involved, contributing to the financing of the bid alongside significant investment from Saudi and Qatari funds.

The intense excitement surrounding this takeover battle serves as a powerful reminder of the profound transformations occurring within the entertainment industry. While much of the recent focus has been on the dominant US tech titans, the seismic shifts in how content is created, distributed, and consumed have not received adequate attention. Even established players like the UK’s ITV are facing takeover bids as they grapple with audiences migrating from traditional linear television to streaming platforms. For investors looking to capitalise on these trends, keeping a close eye on the key players in this unfolding saga is essential. Prepare for a thrilling, albeit potentially turbulent, ride.

What Lies Ahead: Regulatory Hurdles and Future Strategies

The resolution of the Warner Bros. Discovery saga is unlikely to be swift. The US Department of Justice (DoJ) is expected to conduct a thorough scrutiny of any proposed merger, a process that could be lengthy. Ben Barringer, head of technology research at Quilter Cheviot, noted, “We are just at the beginning. Paramount will hope that it has blown Netflix out of the water with this bid but, even if it has, any review by the DoJ is likely to result in a long process.”

Beyond regulatory approvals, speculation is rife about the future strategies of the major players involved. Netflix, historically known for its “builder, not a buyer” approach, may explore other acquisition targets if its bid for Warner Bros. is unsuccessful. This could trigger further consolidation and takeover activity within the broader entertainment sector.

The allure of Warner Bros. also underscores the growing influence of the entertainment divisions of major tech companies. Giants like Amazon and Apple boast significant streaming services, while Google’s YouTube commands an astounding 2.7 billion monthly users, surpassing Netflix in reach.

While a portfolio heavily weighted towards tech stocks might present risks in the current climate, exposure to these transformative companies remains crucial. Investment trusts like Scottish Mortgage, which holds a stake in ByteDance, the unlisted Chinese owner of TikTok, exemplify this exposure. ByteDance boasts an impressive 2 billion customers globally, with 30 million in the UK alone, making it a compelling, albeit unlisted, venture.

Beyond the Takeover: A Love Triangle of Media Giants

The analyst sentiment surrounding Warner Bros. shares offers a glimpse into the potential outcomes. Nine out of the analysts following the company recommend a “buy” at the current elevated share price, while the remaining twelve suggest a “hold.” This suggests that either Netflix or Paramount may need to increase their offers, or a new bidder could emerge, further complicating the landscape.

Before becoming the subject of this intense acquisition interest, Warner Bros. had been planning to address its debt by spinning off CNN and other struggling cable channels into a separate entity. Under Paramount’s proposed merger, CNN would be combined with its own news channel, CBS. Netflix, however, has shown no interest in these cable operations, viewing them as outdated and incongruent with its former image as a tech pioneer.

The historical performance of Netflix is a testament to its strategic evolution. Investors who backed Netflix in 2013 have witnessed its share price skyrocket from $5 to $96. This week, UBS set a target price of $150 for Netflix, reflecting optimism surrounding its successful ventures into advertising, gaming, and live sports. However, any investor considering a stake in Netflix today should be aware that its ambition to become a vertically integrated media powerhouse hinges on the persuasive leadership of executives like Ted Sarandos. The critical question remains: can Sarandos craft a narrative that garners approval from influential figures like Donald Trump?

Shares in Paramount have seen a year-to-date increase of 33 per cent, reaching $14. However, recent declines suggest concerns about the company’s lack of scale in a fiercely competitive market. The current “hold” rating on Paramount shares reflects the potential for the company to overextend itself in its pursuit of dominance in an industry where content reigns supreme.

Other Potential Contenders and Industry Woes

Comcast, the parent company of Sky, has, for the moment, played a supporting role in this drama. However, this $97.6 billion conglomerate would undoubtedly be keen to add Warner Bros. to its NBC Universal division, the studio behind the successful film Wicked: For Good. Comcast remains a potential entrant into the bidding war, although it is currently preoccupied with its proposed acquisition of the broadcast arm of the British entertainment company ITV.

Comcast shares, generally rated a “hold” by most analysts, have fallen by 27 per cent this year to $27. This decline is attributed to concerns that Comcast is significantly outspending its rivals on content acquisition. ITV itself is also rated a “hold,” reflecting the broader challenges facing the traditional media industry, including declining viewership and advertising revenues, despite the potential for a US suitor in Comcast.

Walt Disney: A Giant Standing Aside

The $192 billion Walt Disney empire, established in 1923, now encompasses a vast array of beloved franchises and businesses, including Marvel, Star Wars, The Simpsons, Pixar Animation, the ABC TV network, Disney+ and Hulu streaming services, theme parks, and cruise lines.

Recently, Walt Disney finalised a $1 billion deal with ChatGPT group OpenAI, allowing for the use of its iconic characters in social media videos. Notably, Walt Disney has publicly stated its intention to remain on the sidelines of the Warner Bros. takeover battle, declaring, “We’ve got a great portfolio and don’t need to do anything.”

Analysts generally rate Walt Disney shares a “buy” at $112, with an average target price of $136. This positive outlook is driven by the enduring popularity of its theme parks, subscriber growth in its streaming services, and a robust content pipeline. This perspective is welcome news for Walt Disney investors, especially given earlier speculation that Netflix had considered Disney as a potential acquisition target before focusing its attention on Warner Bros. The future of this industry remains dynamic, with numerous possibilities yet to unfold.